The Foreign Exchange Market

The Forex market is a decentralized, over-the-counter (OTC) financial marketplace that operates 24 hours a day, five days a week (Monday through Friday), utilizing a global electronic network of banks and financial institutions—commonly known as an Electronic Communication Network (ECN). This vast and continuously active trading environment facilitates the exchange of currencies across all time zones. Today, it is estimated that the daily turnover in the Forex market exceeds $5 trillion, making it the largest and most liquid financial market in the world.

What is Forex Trading

Forex, short for Foreign Exchange, is a global electronic network that facilitates the exchange of currencies—one for another. It functions as the backbone of international trade and finance, enabling the conversion of currency pairs that serve as instruments for the global exchange of goods, services, and capital.

Participants in the Forex market include importers, exporters, multinational corporations, institutional investors, and central and commercial banks. Unlike centralized markets, the Forex market operates in a decentralized manner, similar to the structure of the internet. It exists within a global network of financial institutions, known as the Electronic Communication Network (ECN), which connects buyers and sellers across all time zones.

The Forex market is massive, with a daily trading volume exceeding $4 trillion, making it the most liquid financial market in the world. While the rules of Forex differ in many ways from those governing equity and bond markets, there are also notable similarities in trading principles and strategies.

Trading Tips – Essential Information and Insights for the Foreign Exchange Market

Not all Forex currency pairs behave the same. Some pairs exhibit significantly higher volatility and tend to trend more aggressively than others. Understanding these differences is crucial for managing risk and selecting appropriate trading strategies.

Below is a reference table highlighting the relative volatility of major and minor Forex currency pairs:

Table: Forex Currency Pairs & Volatility

|

HIGH VOLATILITY PAIRS |

MEDIUM VOLATILITY PAIRS |

LOW VOLATILITY PAIRS |

|---|---|---|

|

|

|

Understanding the unique characteristics of each currency pair can make a significant difference in trading performance. For this reason, it is often more effective to focus on just a few carefully selected Forex pairs rather than trying to trade 8–10 pairs at once. Concentrating on a smaller number allows for deeper analysis and better decision-making. In the world of Forex, knowledge truly is power.

» Trading Tips for Forex Beginners | » Forex Trading FAQ | » Forex Trading Glossary

Choosing the Best Time to Trade

Certain hours of the day see overlaps between major Forex trading sessions. During these overlap periods, trading volume typically increases, creating greater liquidity and more trading opportunities. Below is a table outlining the key Forex market time zones and their overlapping hours to help you identify the optimal times to trade.

|

Forex Time Zone |

Forex Winter Time Zone (October - April) |

Forex Summer Time Zone (April - October) |

||

|---|---|---|---|---|

|

|

EST |

GMT |

EDT |

GMT |

|

New York (Open-Close) |

8:00 AM |

1:00 PM |

8:00 AM |

12:00 PM |

|

London (Open-Close) |

3:00 AM |

8:00 AM |

3:00 AM |

7:00 AM |

|

Tokyo (Open-Close) |

7:00 PM |

12:00 AM |

8:00 PM |

12:00 AM |

Forex Sessions Overlap

(i) When the European and American markets are both open (between 8 a.m. and 12 p.m. EST), trading currency pairs such as GBP/USD, EUR/USD, and USD/CHF often results in better performance due to increased market activity.

Other favorable trading times include:

(ii) 1 a.m. to 3 a.m. (EST), when the European session is beginning and the Asian session is closing.

(iii) 7 p.m. to 10 p.m. (EST), when the Asian and Australian sessions overlap.

Most Volatile Days of the Week

Volatility tends to vary across the week. Generally, Forex majors experience higher volatility midweek, particularly on Tuesday and Wednesday. Mondays are typically quieter and less volatile, while Fridays often see reduced activity as many traders close their positions ahead of the weekend.

Forex Trading Calendar – When to Trade

Currency pairs often follow seasonal patterns. For example, during April, the British Pound tends to appreciate against the US Dollar more than 80% of the time.

Currency pairs often follow seasonal patterns. For example, during April, the British Pound tends to appreciate against the US Dollar more than 80% of the time.

The Forex majors are the most traded and liquid currency pairs worldwide, accounting for over 85% of total Forex market volume. These pairs offer tight bid-ask spreads, making them highly attractive for scalping, intraday, and algorithmic trading strategies.

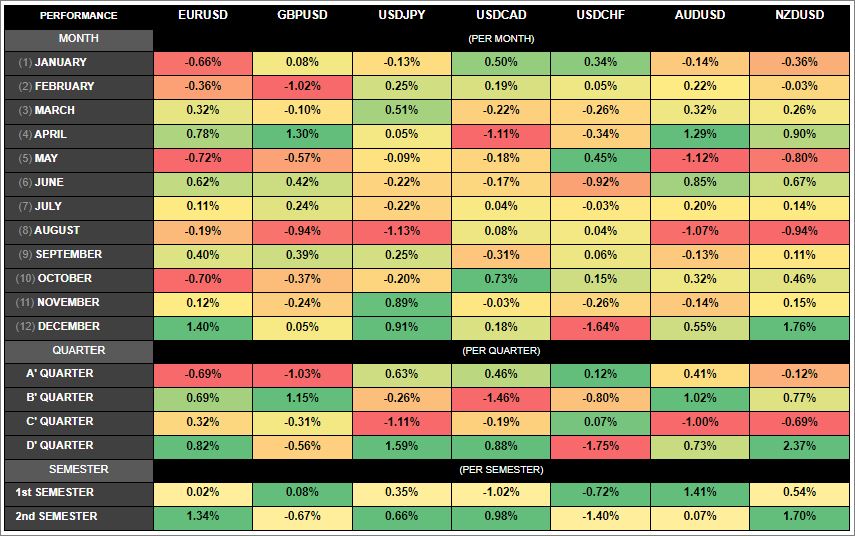

Below is a table comparing the periodic returns of the seven major Forex pairs based on historical data from 2000 to 2018:

Table: Compare the Returns of the 7 Forex Majors

» Find more about when to Trade Forex Pairs

Trading Only Liquid Forex Assets – EUR/USD

EUR/USD is the most popular Forex currency pair in the world. The base currency is the European Euro (EUR), while the counter currency is the US Dollar (USD). Known for its exceptional liquidity, EUR/USD offers some of the tightest trading spreads in the entire Forex market. These narrow spreads make EUR/USD especially attractive to scalpers and algorithmic traders seeking efficient and cost-effective trading opportunities.

» More about the EURUSD Forex Pair

Trading CFDs on Futures

A futures contract gives its holder the right to buy or sell a predetermined quantity of a commodity or asset at a set price on a specific date in the future. Originally, futures contracts were designed for physical commodities like grain, cotton, and coffee. Today, however, they cover a wide range of asset classes, including currencies, bonds, and stock market indices.

When trading CFDs (Contracts for Difference) on futures, the primary cost is the price spread—the difference between the buying price (bid) and the selling price (ask). Unlike traditional futures trading, CFDs on futures typically do not involve additional trading commissions, simplifying the cost structure for traders. Additionally, CFDs on futures do not incur overnight financing fees (SWAPs), which is a significant advantage compared to standard cash CFDs, especially when trading index or commodity CFDs.

Key benefits of trading CFDs on futures include:

-

No trading commissions

-

No overnight financing charges (SWAPs)

-

Costs limited to paying only the spread

» Read more on how to trade CFDs on Futures

Trading the News (Foreign Exchange)

News trading strategies in Forex revolve around key economic indicators such as interest rates, employment reports, inflation data, and economic growth figures.

- Interest Rates

In the United States, the Federal Open Market Committee (FOMC) holds eight regularly scheduled meetings each year—in January, March, April/May, June, July, September, November, and December. These meetings are closely watched by Forex traders, as changes or signals regarding interest rates can significantly impact currency values.

- Employment Reports

Employment and unemployment data play a crucial role in shaping interest rate decisions. Strong employment figures often prompt central banks to adopt a more ‘hawkish’ stance, signaling potential interest rate hikes. Conversely, lower-than-expected unemployment tends to support currency appreciation as it reflects a robust economy.

- Economic Growth Reports

Various economic growth indicators influence Forex markets, including GDP, manufacturing production, retail sales, and housing permits. Positive growth reports generally bolster the domestic currency, reflecting economic strength.

- Inflation Reports

Central banks, such as the Federal Reserve, typically target an inflation rate around 2%. Prolonged periods of high inflation usually lead to interest rate increases. Forex markets tend to favor higher interest rates, so reports indicating strong economic growth combined with rising inflation often drive currency appreciation.

» Read more about how to trade the news in the Forex market

□ Getting Started with Forex Trading

FxPros.net (c) -You are not allowed to copy any content without permission

L MORE on FXPROS.NET