Understanding Market Trends & Trend Identification Systems

Accurately recognizing a strong Forex market trend can lead to significant trading profits. Forex currencies tend to trend well, often making long, directional moves. During these extended trends, the likelihood of making profitable trades increases substantially.

Distinguishing Market Trends

There are two main types of trends:

(i) Primary Trend

The primary trend is the major market trend. It can last for weeks, months, or even years and typically includes several shorter-term secondary trends. According to Dow Theory, the primary trend strongly influences secondary or minor trends within the same market. Long-term goals of key central banks—especially the Federal Reserve (FED)—play a major role in shaping these primary trends.

(ii) Secondary Trend

A secondary trend is less significant than a primary trend and can last from hours to weeks. These trends often move in the opposite direction of the primary trend and include short-term corrections, take-profit phases, or bear market rallies.

Ranging Markets

Secondary trends also occur in flat or sideways markets, where prices move within a defined range. When the price reaches the upper or lower boundary of this range, it often retraces in the opposite direction, beginning a new secondary trend. This behavior is characteristic of ranging markets.

Multiple Trends in the Same Market

The same market can exhibit different trends across various timeframes. The best approach for identifying these trends is a ‘Descending Approach’, which means starting from higher timeframes and then moving to lower ones.

For example, begin with the Monthly, Weekly, and Daily charts, then move down to H4 (4-hour) and H1 (1-hour) charts.

Shorter timeframes are most useful for optimizing entry and exit points in the market.

Forex Trend Duration

Forex market trends can last from hours to days, weeks, months, or even years.

-

Short-term (secondary) trends usually arise from temporary inefficiencies between supply and demand and tend to last for short periods.

-

Market squeezes, whether short or long, can trigger short-term trends.

-

Long-term (primary) trends develop according to new fundamental data and reverse only with major fundamental changes, allowing them to persist for years.

Identifying the Forex Trend

The simplest and most practical method to identify market trends is by observing the sequence of highs and lows:

-

A bullish market forms a series of higher highs and higher lows.

-

A bearish market forms a series of lower highs and lower lows.

Additional methods and tools to identify trends include:

-

Analyzing chart/candlestick patterns for strong continuation or reversal signals.

-

Using harmonic patterns to spot continuation or reversal patterns.

-

Observing how exchange rates react at major support and resistance levels.

-

Applying Fibonacci retracement levels, particularly the 0.618 level in Forex trading, to identify potential reversals.

-

Watching the behavior of major moving averages, especially their crossings — in strong trends, moving averages typically align in perfect order.

-

Employing technical analysis tools that identify trend and volatility, such as Bollinger Bands.

Automated Systems for Trend Identification

There are trading systems designed to help easily identify trends and generate trading signals. Always test any trading system for several weeks on a demo account before using it with real money. For MT4/MT5 users, MetaTrader’s built-in automated historical backtesting tool is a useful resource for this purpose.

(1) Forex Trendy (All Platforms)

-

Type: Trend Scanner (34 pairs in 9 timeframes)

-

Signals: eMail, Desktop/Sound Alerts

-

Platforms: All platforms

-

Cost: $37 for 3-months ($3/week)

» Visit the Forex Trend Scanner

Forex Trendy is a stand-alone Forex trading system that focuses solely on real price action. The system identifies trends without relying on indicators. Forex Trendy scans 34 Forex pairs across 9 different timeframes, ranging from 1 minute to 1 month.

Forex Trendy is a stand-alone Forex trading system that focuses solely on real price action. The system identifies trends without relying on indicators. Forex Trendy scans 34 Forex pairs across 9 different timeframes, ranging from 1 minute to 1 month.

The system generates reports based on:

-

Master Trend Identification

-

Chart Pattern Recognition

-

Pattern Break-Outs Recognition

-

Flags, Triangles, and Trend Lines Recognition

Member's Area

Forex Trendy provides access to a dedicated members’ web page with the following features:

-

Visualized interface with one-click customization

-

Daily reports identifying flags, triangles, wedges, and trend lines

-

Trade signals based on 34 currency pairs and 9 timeframes

-

Signal delivery via email and desktop alerts

» The Forex Trend Scanner | » Forex Trendy Review

(2) EA Builder for Building Custom Systems (Create Manual/Automated systems for MT4, MT5, and TradeStation)

-

Type: Create Custom Trend Systems (All timeframes)

-

Signals: E-mail, SMS, Desktop Alerts

-

Platforms: MT4, MT5, TradeStation

-

Cost: Free for Indicators / Paid only for creating EAs

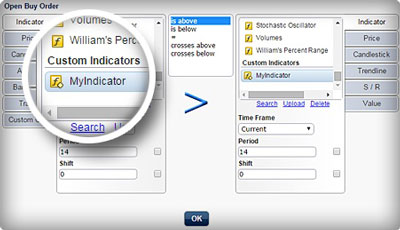

EA Builder is a powerful web-based tool for creating custom trend indicators. The app is completely free, easy to use, and requires no programming skills.

EA Builder Features

EA Builder Features

-

Completely free for building any indicator, only paid for building EAs

-

Transforming any ideas into Indicators and Expert Advisors (Forex Robots)

-

Compatible with MT4/MT5 and TradeStation platforms

-

Trading Currencies, Stocks, Indices, ETFs, Bonds, and all Commodities

-

Full technical analysis tools (Indicators, Oscillators, Trendlines, etc.)

-

Full money management (MM) functions (such as spread and slippage control and timing any new position)

-

Alerts via email, desktop, and SMS

-

Suitable for building both manual and automated trade systems

-

Can be used in unlimited Demo/Real accounts

» EA Builder Online App | » Learn more about how to create custom EAs

■ Identifying the Forex Market Trend

FxPros.net (c)

L MORE on FXPROS.NET • COMPARE • LEARNING • TRADE SYSTEMS

□ Broker Ratings

□ Expert Advisors

□ Forex Brokers

► Getting Started with Forex

► Getting Started with Trading Systems

► How to Choose a Forex Broker

► Getting Started with Algorithmic Trading

► Identifying the Forex Trend

► Overlays and Indicators

► Forex Trendy

► 1000pip Climber

► EA Builder

► StrategyQuant