Algorithmic or automated trading refers to the complete automation of the trading process—from decision-making to market execution—using a combination of computer software and hardware. An algorithmic trading system must be capable of executing and modifying trades 24/7 without any human intervention.

Algorithmic or automated trading refers to the complete automation of the trading process—from decision-making to market execution—using a combination of computer software and hardware. An algorithmic trading system must be capable of executing and modifying trades 24/7 without any human intervention.

Algo Trading Basic Assumptions

These are the major assumptions of algorithmic trading:

-

Historical results have at least some predictive power (Sharpe, 1994).

-

Financial markets are not perfectly efficient, at least in the short term.

-

Financial markets have limited depth.

-

Patterns or regularities in financial data exist but only for short periods; a window of opportunity may open and then close later.

-

Financial data (prices and volumes) are influenced by human psychology and societal decisions, making them random and unstable.

Basic Components of an Algorithmic System

An algorithmic trading system has two fundamental components:

-

The Forecasting Module

-

The Action Module

General Categories of Algorithmic Trading

According to Mitra, di Bartolomeo, and Banerjee (2011), there are five main categories of algorithmic trading:

-

Algorithmic Executions -Executing speculative trades based on mathematical algorithms. For example, creating an Expert Advisor that runs on a trading platform and automates a trading strategy.

-

Statistical Arbitrage -Automated trading based on historical market data and identifiable cyclical patterns.

-

Crossing Transactions -Finding a counterparty for a trade without revealing transaction details to other market participants.

-

Electronic Liquidity Provision -Being willing to buy or sell assets upon request from counterparties.

-

Predatory Trading -Placing thousands of simultaneous orders while expecting to execute only a small fraction to influence market prices.

Expert Advisors (EAs) — Simplified Algorithmic Trading for Retail Traders

Expert Advisors (EAs) are software programs that run on trading platforms and fully automate the trading process. They use algorithms to analyze the market and execute trades automatically based on predefined rules and conditions.

» Review Expert Advisors at FxPros.net

Creating Custom Expert Advisors

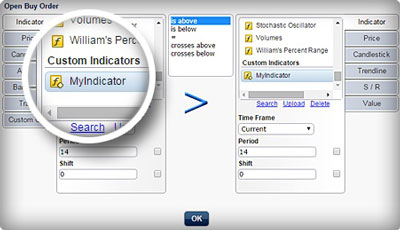

The EA Builder is a web-based application that helps traders convert their trading ideas into fully automated systems. No programming skills are required, so even beginners can create complex Expert Advisors. The EA Builder also allows users to create simple indicators for free. It supports trading any financial asset (Forex, equities, commodities) on three platforms: MT4, MT5, and TradeStation.

EA Builder Basic Features:

-

Free for creating indicators on MT4, MT5, and TradeStation; only paid for creating Expert Advisors.

-

100% web-based application; no programming skills needed.

-

EA Builder Expert Advisors can trade any financial market (Forex, equities, commodities).

-

EAs can trade any asset in any timeframe; binary options trading is also supported.

-

Highly customizable EA building with many functions; alerts via email, audio, and on-screen.

-

Full money management controls, including spread and slippage management, and sensitive orders.

-

Binary options trading is also available directly on MetaTrader 4.

-

Can be used on unlimited real and demo accounts.

» EABuilder Website | » Learn more on how to Create Expert Advisors with EA Builder

Algorithmic Platforms and StrategyQuant

Algorithmic Platforms and StrategyQuant

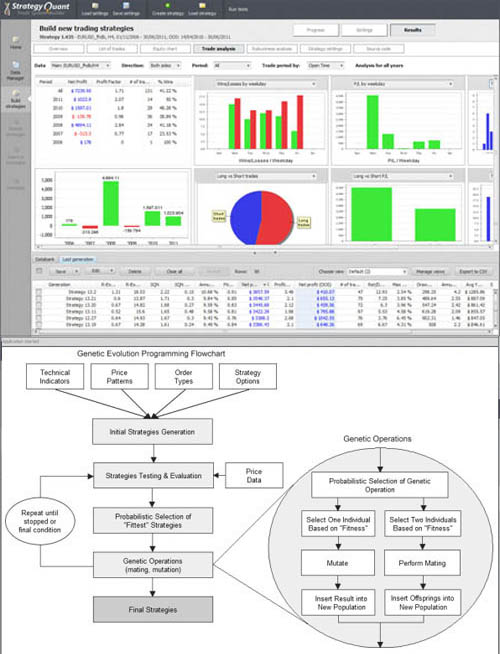

StrategyQuant is an innovative platform for creating automated trading strategies across any market, without programming skills. It helps traders optimize and backtest their auto-trading systems using a wide range of built-in tools.

StrategyQuant Basic Features:

-

Access thousands of pre-built automated strategies or build your own from scratch.

-

Sophisticated backtesting and step-by-step optimization.

-

Trade any financial market (Forex, equities, cryptocurrencies, bonds, etc.).

-

Four modes: developing, re-testing, improvement, and optimization.

-

Generates Expert Advisors for MT4, MT5, NinjaTrader, or TradeStation.

-

Offers a fully functional 14-day free trial.

-

Provides customer support and has an active community of thousands of members.

» Learn more about StrategyQuant Platform | » StrategyQuant's free 14-day trial

Tools for Algorithmic Trading Systems

Common tools used for building and optimizing algorithmic trading systems include:

-

Pattern Recognition (machine learning)

-

Order/Volume Breakout Analysis

-

Time Series Analysis

-

Intermarket Correlations Analysis

-

Market Sentiment Measures (analyzing the positivity/negativity in language related to events)

-

Historical Backtesting

-

Monte Carlo Simulation (using random sampling for problem-solving)

-

Hamilton–Jacobi–Bellman (HJB) Equation (used in optimal control theory)

-

Queuing Theory (predicting waiting times and queue lengths)

-

Sharpe and Sortino Ratios (measuring risk-adjusted returns by separating harmful from total volatility)

□ Algorithmic Trading

G.P. for FxPros.net (c)

-You are not allowed to copy any content without permission

L MORE on FXPROS.NET • COMPARE • LEARNING • TRADE SYSTEMS

□ Broker Ratings

□ Expert Advisors

□ Forex Brokers

► Getting Started with Forex

► Getting Started with Trading Systems

► How to Choose a Forex Broker

► Getting Started with Algorithmic Trading

► Identifying the Forex Trend

► Overlays and Indicators

► Forex Trendy

► 1000pip Climber

► EA Builder

► StrategyQuant